Market changes shaping mobile acquisition strategies

High app store commissions and growing competition are putting pressure on mobile businesses. For subscription-based apps, relying only on in-store acquisition and payments is becoming harder to sustain at scale. This is why more mobile developers are moving key conversion and subscription steps to the web, where they have greater control over pricing, offers, and user flows. These changes are visible across the market and are reflected in the State of Web2App 2026 report based on real web-to-app data.

In 2026, FunnelFox released its first industry-wide report, offering a data-driven view of how web-to-app funnels are used in mobile acquisition today. FunnelFox is a platform focused on web funnels for mobile apps, working at the intersection of acquisition, conversion, and monetization. Instead of focusing on individual case studies, the report analyzes thousands of real funnels (referred to as Web2App in the report) used by mobile apps across different markets and verticals.

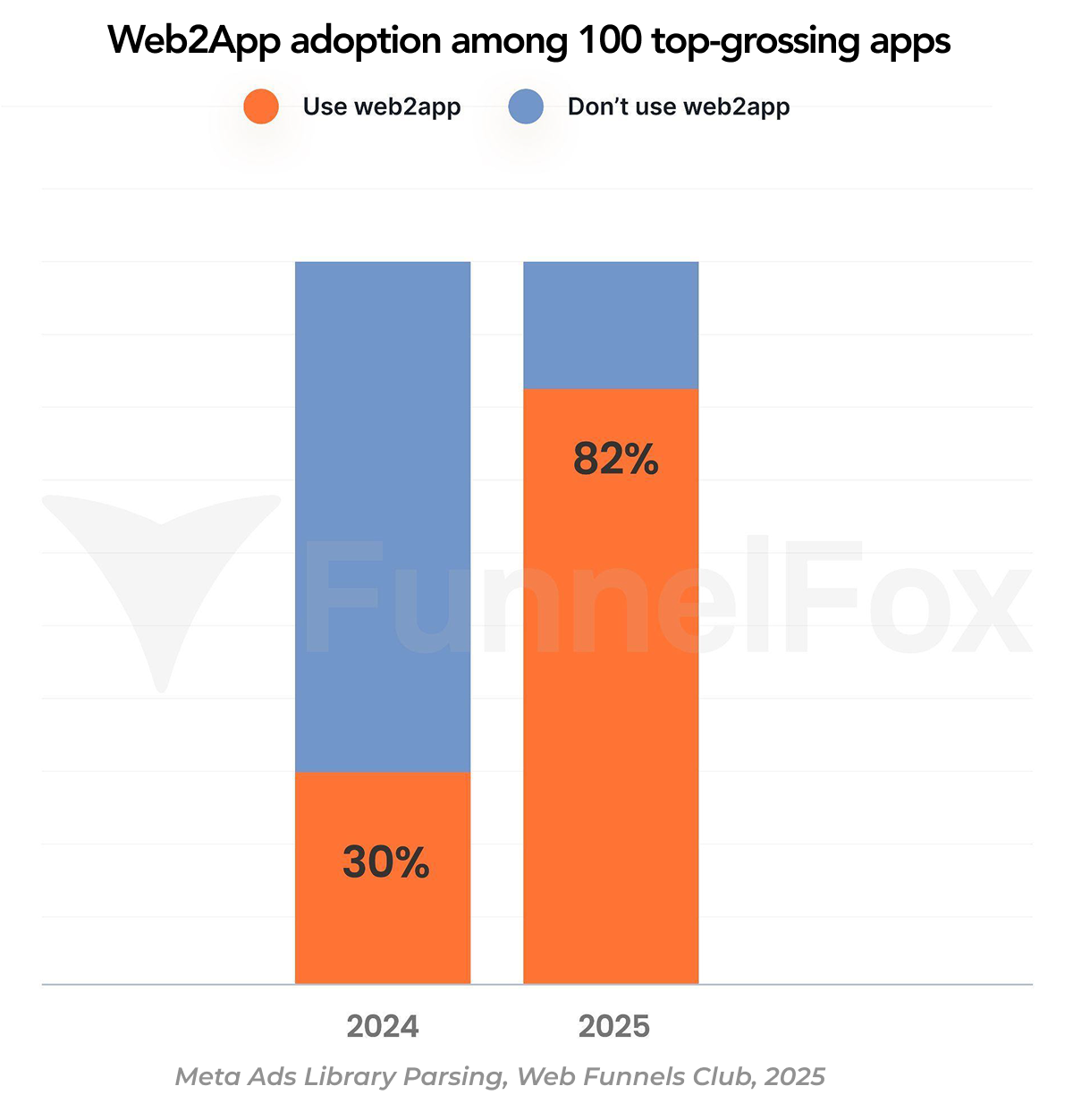

The data points to a structural shift in acquisition strategy. The number of mobile apps using web-driven funnels before the app store grew by 77% YoY, and 82% of top-grossing apps now rely on this approach as a core part of their growth stack.

AdOperator focuses on these patterns because, from our perspective as an advertising network working with mobile traffic at scale, they align with how acquisition teams operate in practice.

Mobile web traffic is embedded into funnel design — shaping user qualification, setting expectations, and influencing conversion at the pre-install stage. In this setup, early web-stage decisions affect monetization efficiency and overall profitability.

How mobile web traffic became a core part of mobile acquisition

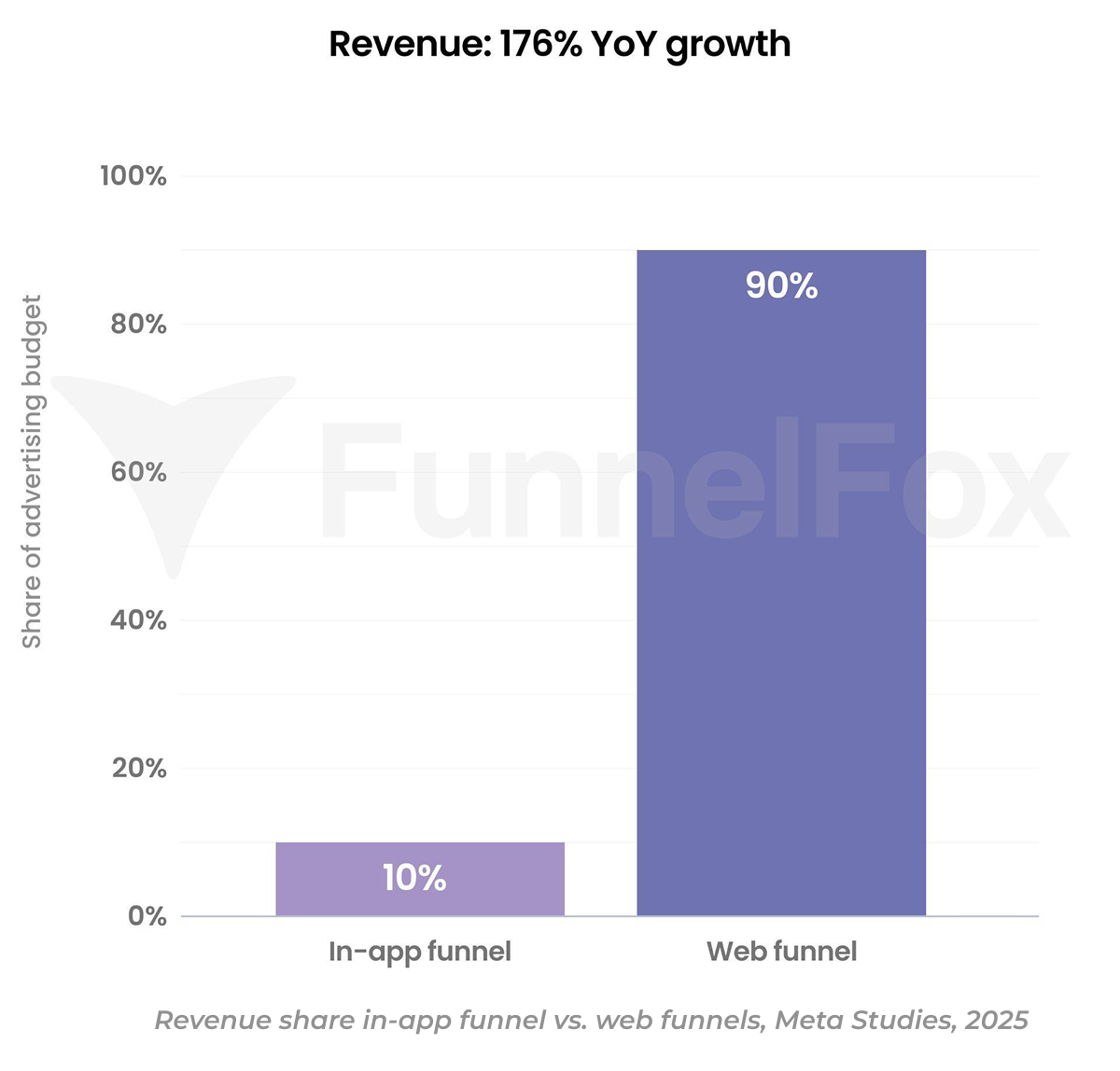

The FunnelFox report highlights that the mobile web has moved far beyond a supporting role in app acquisition. According to the data, up to 90% of total revenue for high-performing apps now comes from acquisition flows that include a web step before the app store, indicating that a substantial part of value creation happens before installation.

This revenue shift is mirrored by rapid growth in Web2App execution. The volume of related ad creatives has increased by more than 250% YoY, reflecting broader operational adoption across acquisition teams.

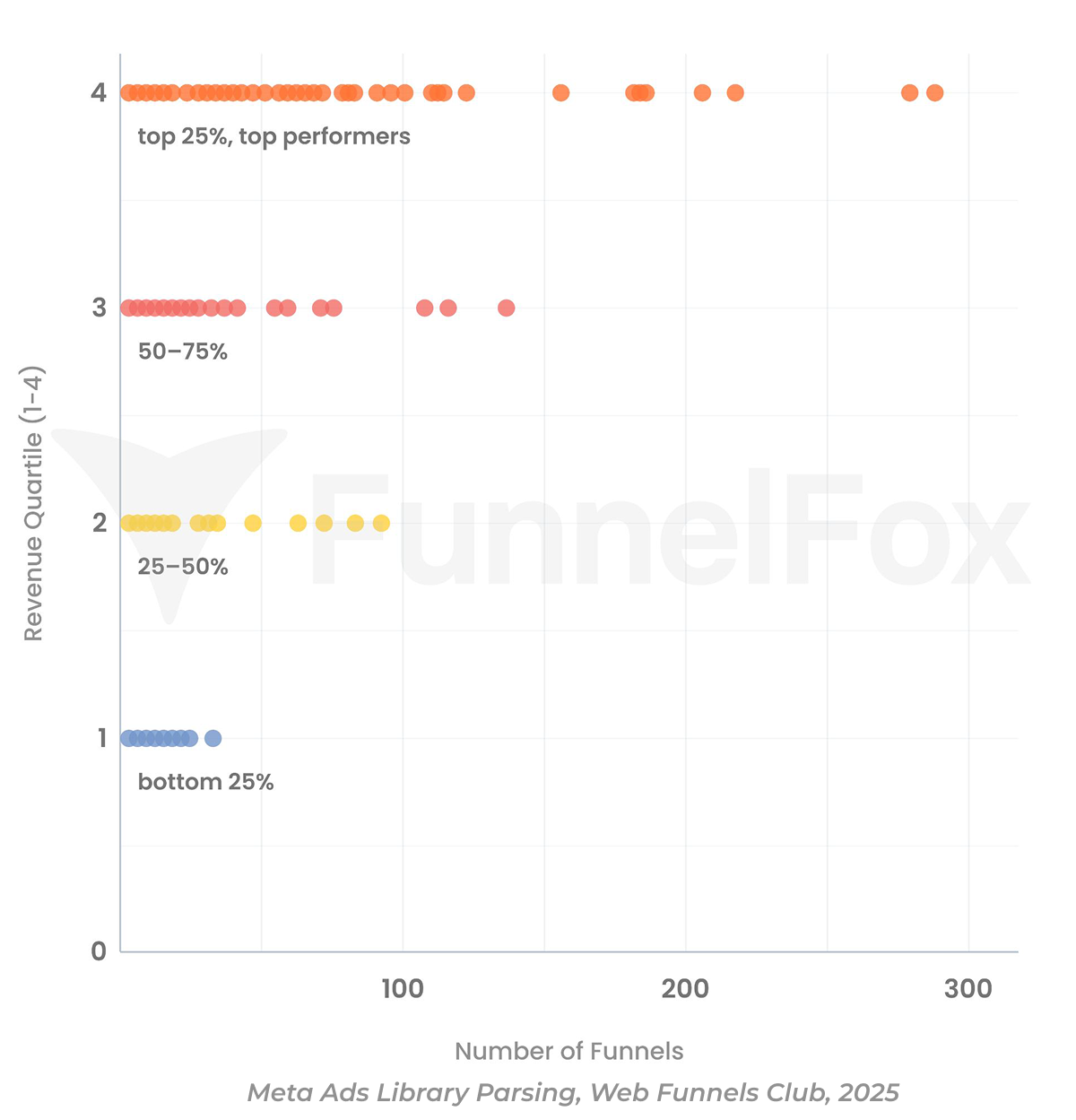

The report also shows that revenue performance differs by the number of active web funnels. Apps operating multiple web-based funnels tend to demonstrate stronger revenue results than those running only a limited setup.

As web execution expands, experimentation is no longer limited to in-app tests. Teams iterate on messaging, pricing logic, and funnel configuration in web-based flows, where changes are faster to deploy and easier to control.

In this context, operating multiple funnels requires traffic that is stable and cost-efficient enough to sustain parallel execution. The quality and structure of this traffic form how effectively funnels scale and how much value they generate over time.

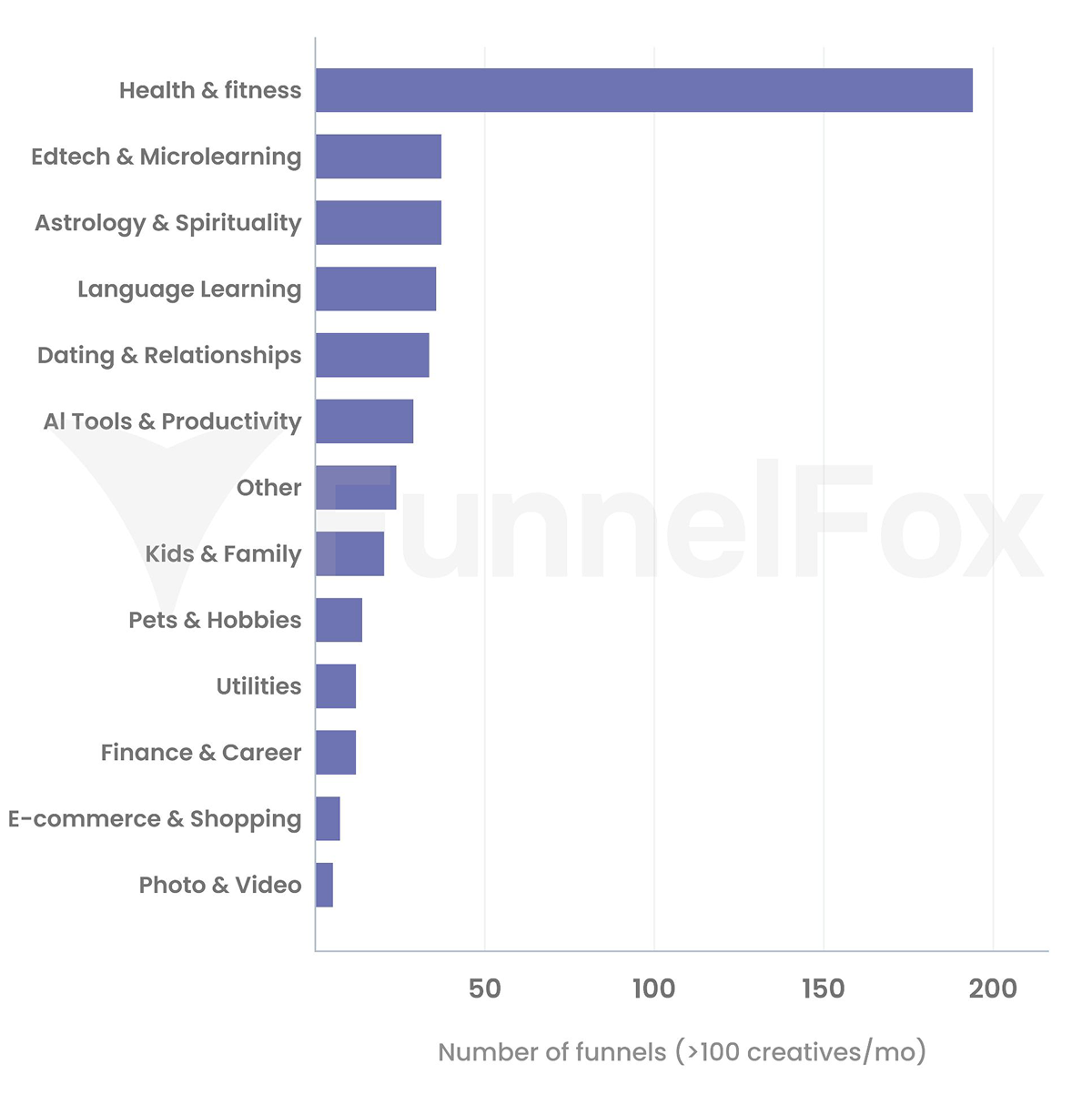

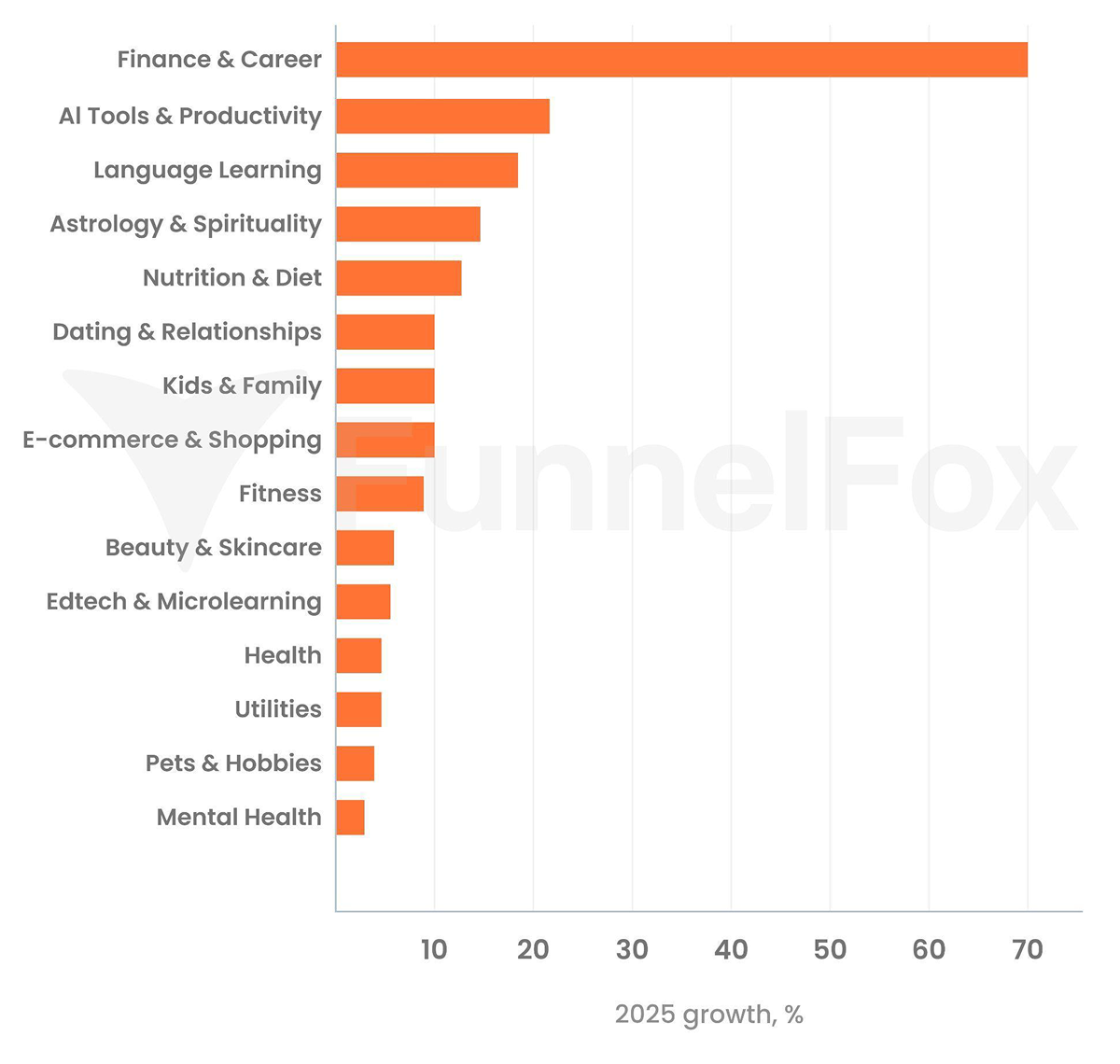

Adoption varies by vertical. Health & Fitness leads in the number of active Web2App funnels, reflecting a high level of structural adoption.

At the same time, Finance & Career shows one of the fastest growth rates in 2025, suggesting that web-first models are expanding across different verticals.

As a result, decisions that were traditionally made post-install — such as positioning, monetization logic, and offer framing — are often addressed before installation. Across verticals, the mobile web has become the primary space where these decisions are tested and refined, shaping downstream conversion and long-term value.

Why web-first funnels outperform direct app store traffic

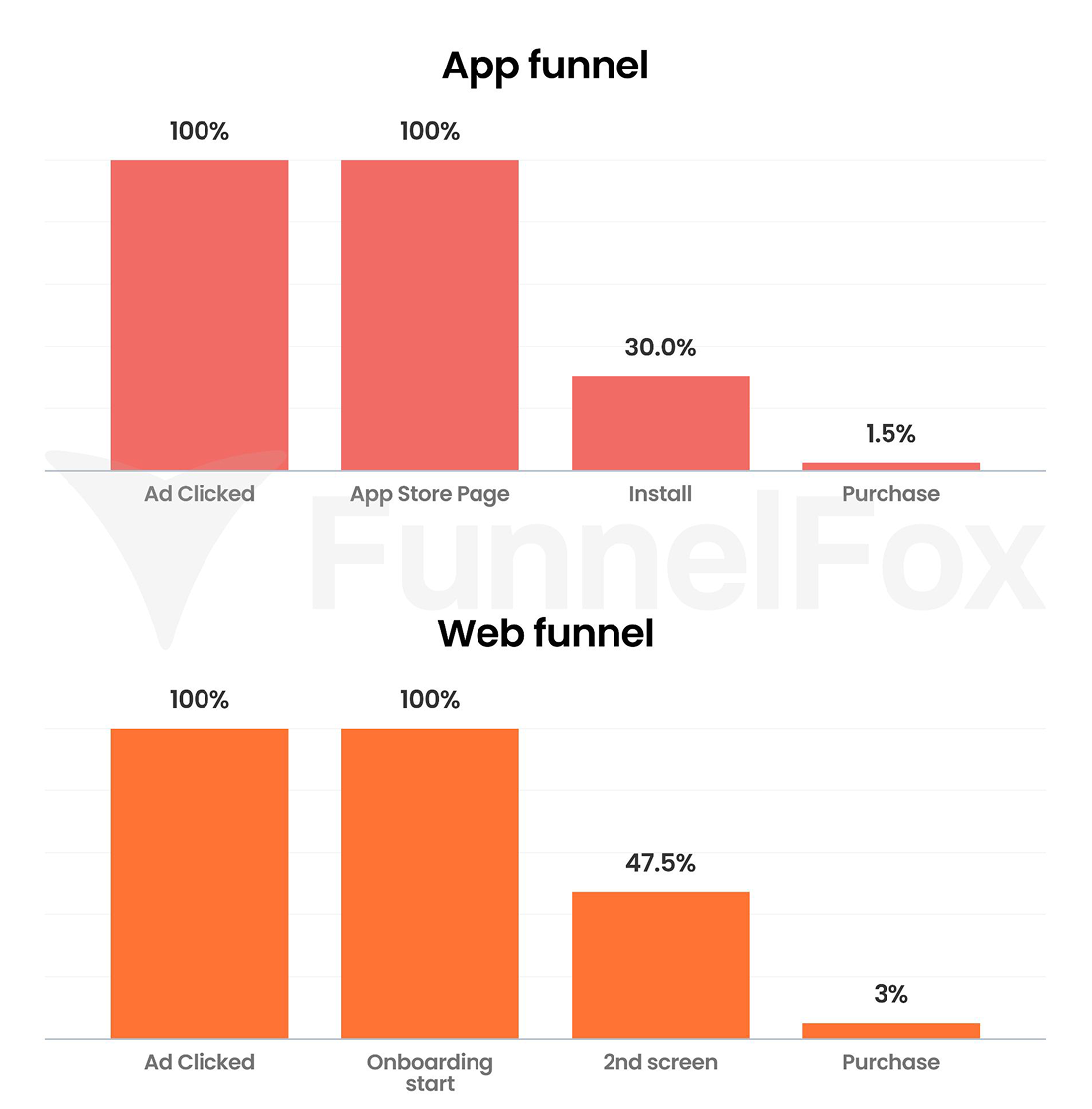

Based on the insights from the FunnelFox report, there is a clear performance gap between classic direct-to-store acquisition and funnels that route users through a web step first. Apps using Web2App funnels tend to achieve higher conversion rates and stronger monetization outcomes than those sending traffic straight to the app store.

One of the most telling findings is that Web2App funnels deliver up to a 2× conversion uplift compared to traditional in-app–only flows. When more users reach monetization-ready stages before installation, ad spend becomes easier to align with revenue outcomes and ROAS targets. This difference appears to be linked to how the early stages of the funnel are structured rather than to a single isolated optimization.

Funnels that include a web layer convert better because they allow teams to:

— communicate product value before installation, reducing uncertainty at the app store stage;

— qualify users earlier, instead of relying on post-install filtering;

— control messaging, pricing, and offers outside app store limitations;

— reduce early drop-offs by aligning user expectations before install.

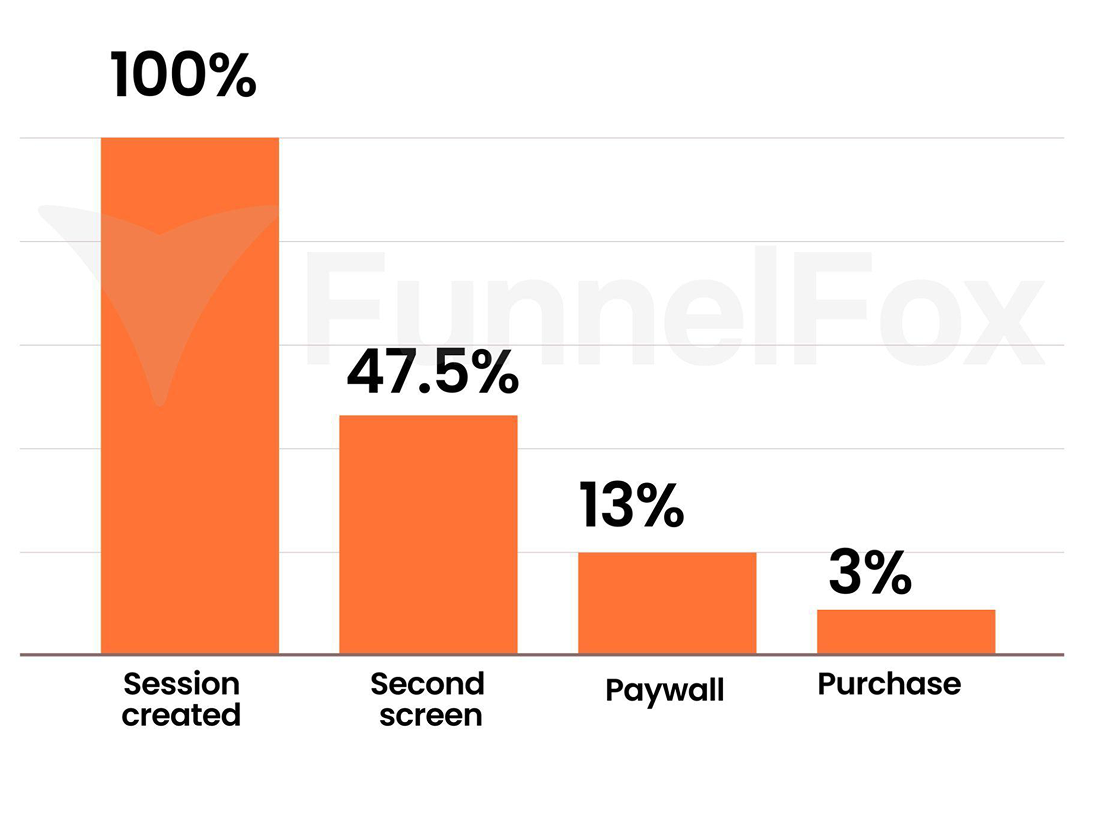

The report also indicates where conversion is most commonly lost. According to the data, only 13% of users reach the paywall stage, while just 3% complete a purchase.

These figures highlight how much acquisition performance depends on user engagement and qualification before monetization is introduced. Web-based funnels give teams control over these stages before users enter the app store environment.

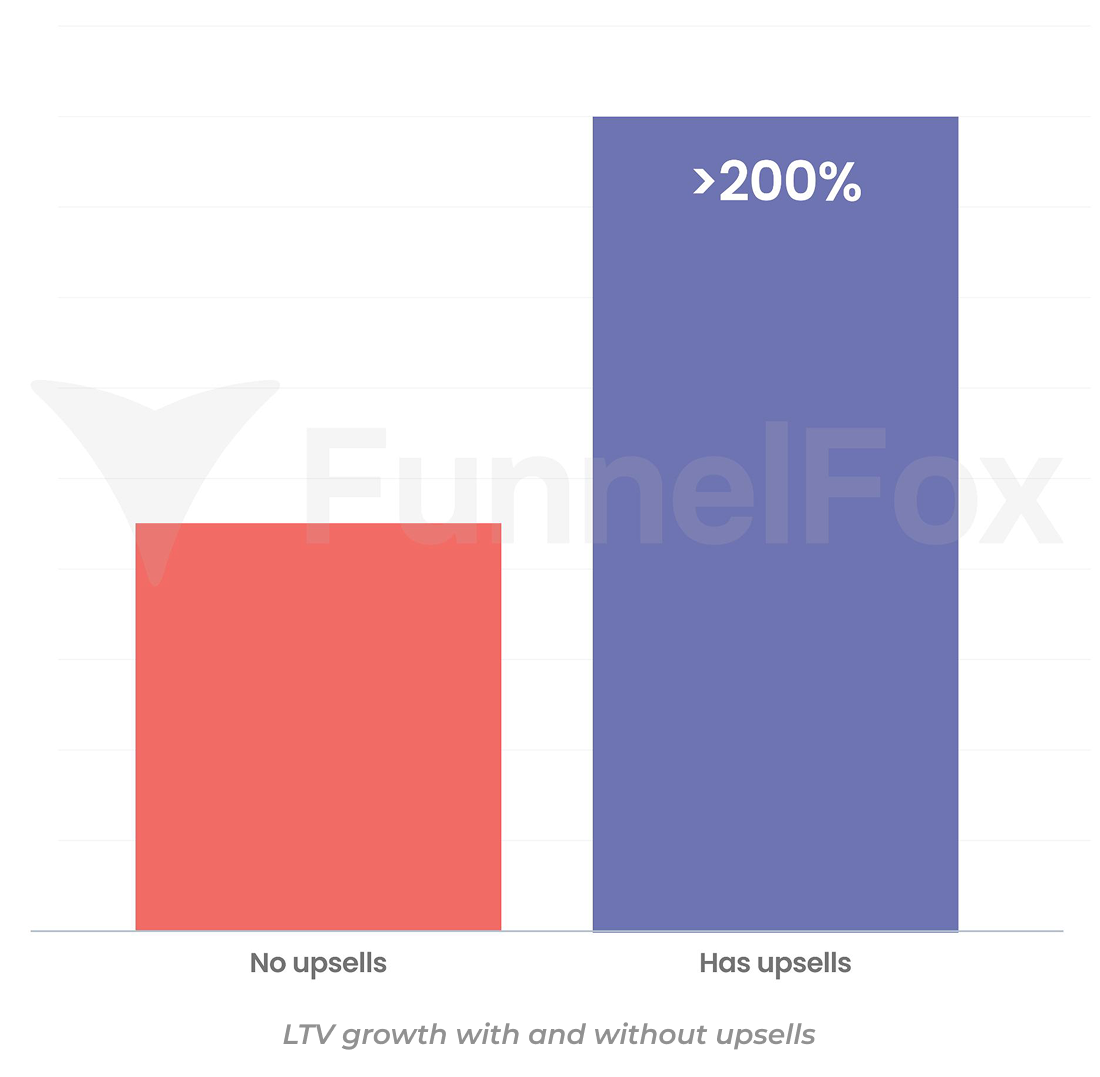

The report also quantifies the effect of upsells within Web2App funnels. Funnels that include upsell mechanics demonstrate a 2× revenue lift in median terms compared to flows without additional offers. As noted, upsells act more as multipliers of existing value rather than independent revenue drivers.

What makes mobile web traffic critical for web-first funnels?

Teams working with web-to-app funnels are not looking for traffic that simply drives installs. They are focused on how and where to buy mobile web traffic that can support web-based acquisition at scale and feed controlled, measurable funnels rather than one-off campaigns.

On the AdOperator platform, mobile web traffic has become the most requested traffic type. This demand reflects how acquisition models are being built today.

To support these models, mobile web traffic needs to meet several key requirements:

— stability at higher volumes, allowing funnels to run without volatility;

— predictable user behavior, enabling reliable optimization;

— flexibility for segmentation so that traffic can be routed across multiple funnels;

— compatibility with rapid testing, supporting frequent iterations and experiments.

What does this mean for ROAS-driven teams in 2026?

The FunnelFox data points to a shift toward web-first funnels, where more control over performance is moved earlier in the user journey. By influencing intent and conversion readiness before the app store step, teams create better conditions for managing acquisition efficiency and ROAS.

The app store is no longer treated as the primary conversion layer. More control moves to the web, where funnels can be tested and optimized before installation. In this environment, access to stable, scalable mobile web traffic shifts from a tactical advantage to a baseline requirement for competing effectively.

As competition for installs intensifies and acquisition models continue to evolve, teams that invest in web-first funnel design and secure reliable access to mobile web traffic are better positioned to improve return on ad spend and adapt to future ecosystem changes.

At AdOperator, we work with mobile web traffic, enabling teams to build and scale funnels that operate upstream of the app store and focus on ROI and revenue growth.