Why Vietnam is an Attractive GEO for iGaming Ads?

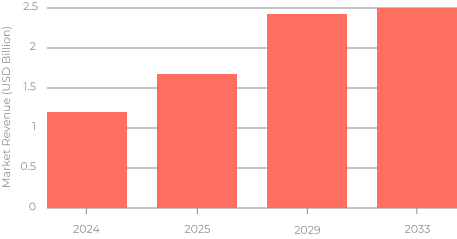

Vietnam’s iGaming and online gambling market is one of the fastest-growing in Southeast Asia. With a population of over 100M and more than 84M smartphone users [1], the country is firmly mobile-first — exactly where iGaming funnels scale fastest. The entire Vietnamese iGaming market is valued at approximately $1.2–1.6 billion in 2025 and is projected to exceed $2.4 billion by 2029 [2].

Vietnam iGaming Market Forecast, 2024–2033. Source: iGamingToday, 2024

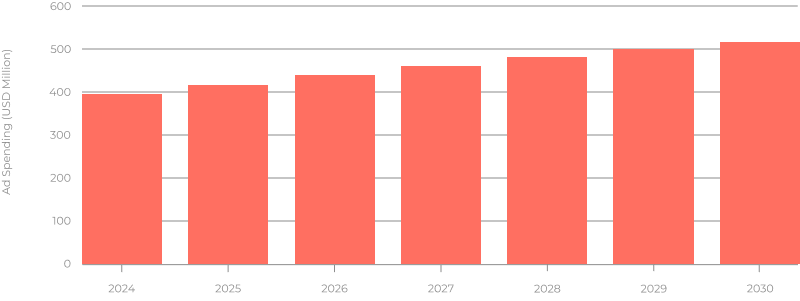

By 2030, three out of four digital ad dollars are expected to come from mobile banners [1], making Vietnam a market where mobile ads and mobile payments significantly influence the user experience. Digital ad spending continues to climb, reaching $395.9 million in 2025 and projected to surpass $514.9 million by 2030 [1].

Digital Ad Spend Growth in Vietnam, 2023–2030. Source: Statista, 2025

Around 60% of Vietnam’s population is under 35 [3], making it one of the youngest and most digitally active demographics in Asia. This generation spends a significant amount of time online — on social networks, gaming, and short-form video — and is naturally responsive to gamified, visually dynamic advertising. Combined with growing e-commerce and mobile payments, Vietnam offers fertile ground for affiliates and advertisers seeking high-quality, scalable traffic.

Market Background & Legacy.

Vietnam’s iGaming market has evolved uniquely. For years, land-based casinos were open only to foreign visitors, leaving local players without legal entertainment options. A limited government pilot (2019–2024) briefly allowed Vietnamese citizens to gamble in selected casinos, but it was discontinued, and online restrictions remain in place as of 2025.

While iGaming is formally prohibited, real user demand has never gone away. With no legal online options available, many players turn to offshore platforms, often using VPNs or indirect entry points promoted via ad networks. This mismatch between strict regulation and high demand has effectively created a grey market where traffic continues to thrive.

Authorities periodically announce large-scale crackdowns on illegal betting, reinforcing the official ban. Yet user interest remains strong, and advertisers who operate cautiously — using neutral messaging, localized communication, and transparent payment flows — continue to see consistent engagement.

Vietnam’s iGaming landscape today reflects this balance: a compliance-sensitive environment with high user demand and significant growth potential for those who adapt creatively and responsibly. This historical context sets the stage for understanding who today’s Vietnamese iGaming players are — and how they behave online.

The iGaming Audience in Vietnam.

Vietnam’s iGaming audience reflects the country’s youthful digital profile and rapid shift toward mobile entertainment.

Demographics: a young and urban audience.

The country’s iGaming audience is dominated by digital natives — a generation that grew up with smartphones and social media, shaping how entertainment and advertising are consumed online. Around 70% of iGaming players in Vietnam are between 18 and 34 years old, and nearly 80% live in urban areas such as Ho Chi Minh City and Hanoi [2]. This urban, tech-savvy segment drives demand for mobile-first, interactive formats.

User behavior and device habits:

— Vietnam is firmly mobile-first: smartphones are the main entry point for digital services. This aligns with iGaming funnels, where fast onboarding and mobile payments are critical.

— Social media and short-form video platforms dominate daily screen time, shaping expectations for fast, visual, and interactive ad formats.

— Users are promo-driven — welcome bonuses and free spins remain key motivators.

Game preferences and interests:

— Slots and lotteries remain the most popular entry-level products, valued for simplicity and quick play.

— Live casino formats attract younger players looking for social interaction.

— Sports betting, especially football, is consistently in demand, reflecting the sport’s massive cultural relevance in Vietnam.

Trust and risk perception.

Vietnamese players tend to be cautious toward unknown brands. They value transparency, recognizable payment options, and clear communication. Campaigns that use Vietnamese language, local visuals, and realistic messaging convert best — while overly aggressive claims or foreign-only branding reduce trust.

Cultural Insights & Creative Strategies.

Understanding Vietnam’s cultural context is essential for building ad funnels that convert. Users are young, mobile-first, and visually driven — which means that generic templates rarely perform.

Creatives that work:

— Bright, dynamic visuals with a clear story (e.g., sports moments, celebration scenes) outperform static banners.

— Localized language is a must: Vietnamese copy, culturally familiar metaphors, and references to local holidays (Tet, Mid-Autumn Festival) drive higher CTR.

— Subtle positioning as an entertainment activity is safer than direct gambling promises, especially under moderation filters.

Examples of localized banner

Pre-landers that include light interaction — such as mini-quizzes, countdowns, or “spin-the-wheel” mechanics — help warm up users before the main offer and create a sense of entertainment rather than risk.

Landing pages should remain simple, mobile-optimized, and transparent, with visible trust markers like secure payment logos and clear terms and conditions.

Landing flows in Vietnam should combine vivid visuals, cultural adaptation, and trust signals. These creative approaches translate directly into how campaigns should be tested and optimized for long-term performance.

Traffic Sources & Ad Formats

Digital advertising in Vietnam is diverse, but not every channel is equally reliable for iGaming campaigns.

Social platforms like Facebook, TikTok, and YouTube remain the top channels by volume but are highly moderated. Advertisers rely on neutral creatives (entertainment, lifestyle, sports) and pre-landers to pass reviews safely.

Ad networks, by contrast, offer flexibility and scale. Push and popunder formats remain dominant, providing both reach and conversion quality. According to internal AdOperator data, average Push CPC is around $0.055 [4] — higher than in the Philippines or Pakistan, but reflective of stronger traffic quality. Popunder CPM remains lower than Tier-1 GEOs such as the US or France [4], making it attractive for scaling entry-level campaigns.

Native ads and banners align well with Vietnam’s preference for visual storytelling. Interactive, animated creatives in Vietnamese resonate strongly with Gen Z and millennial users. Video ads (especially on TikTok and YouTube) are powerful for pre-lander storytelling, but they require careful moderation compliance.

Setup and Optimization Tips

Launching iGaming campaigns in Vietnam requires precision and patience. The market rewards advertisers who test methodically, localize their funnels, and adapt to user behavior.

Effective testing starts with variety: try several creatives early — different visuals, CTAs, and tone-of-voice — to see what resonates fastest. Run parallel tests for pre-landers to compare user flow and engagement time — not just clicks. However, success depends on more than click-through rates: track first-time deposits and long-term retention to measure true performance.

Mobile traffic peaks in the evening and on weekends, so scheduling around these windows improves CTR. Urban audiences usually convert better, supported by faster internet and wider use of e-wallets.

From a budgeting standpoint, combine cost-efficient popunders for reach with push ads — to deliver stronger conversion quality. Start small, scale gradually, and increase bids only for proven placements.

Finally, rotate creatives every 1–2 weeks to avoid fatigue; Vietnam’s young audience quickly loses interest in repetitive content. Use a tracker to filter underperforming sources early and reallocate budget toward high-quality segments.

Payment Methods

Payments are a critical part of Vietnam’s iGaming ecosystem. While the market remains legally restricted, users are highly accustomed to digital transactions, which reduces friction for deposits and withdrawals.

Vietnam has one of the most advanced e-wallet ecosystems in Southeast Asia, led by MoMo, ZaloPay, and VNPay, which together reach tens of millions of users [5]. By 2025, digital wallets are expected to process most online payments in the country, making them the default method for deposits and withdrawals in iGaming funnels.

Credit cards (Visa, Mastercard) are used mainly by urban professionals, while local bank transfers are less common for entertainment due to slower processing. Vietnam also ranks among the world’s top countries for crypto adoption — younger, tech-oriented users increasingly choose digital assets for privacy and speed.

Players value speed, transparency, and trust. Multi-step flows or unclear fees lead to drop-offs, while visible wallet logos and secure transaction markers significantly improve conversions.

Wrapping Up: Key Takeaways for 2025

Vietnam is a compliance-sensitive but high-potential GEO. To succeed, affiliates and advertisers should focus on localization, simplicity, and sustained trust.

Five essentials to remember:

1. Mobile-first mindset. Over 80M smartphone users and 60% of the population under 35 make Vietnam one of the youngest and most digital-savvy markets in APAC.

2. Smart mix of formats. Popunders provide affordable reach, while push and native ads deliver higher-quality FTDs and more consistent engagement.

3. Localized creatives win. Vietnamese language, cultural references, and authenticity outperform global templates.

4. Payments shape funnels. E-wallets (MoMo, ZaloPay, VNPay) dominate, crypto is on the rise, and players prefer small but frequent deposits. Showing payment security upfront directly increases trust and conversion.

5. Sustainable growth. Online gambling is officially restricted, but demand is high. Neutral messaging, transparent funnels, and compliance-minded creatives are key to long-term campaign stability.

With a market expected to more than double by the end of the decade, Vietnam’s combination of scale, youth, and digital adoption makes it one of the most promising iGaming GEOs in Asia.

[1] Market Insights // Statista: https://www.statista.com/outlook/amo/advertising/digital-banner-advertising/vietnam

[2] Vietnam iGaming Market Research Report // iGamingToday: https://www.igamingtoday.com/vietnam-igaming-market-research-report/

[3] Vietnam Age Structure // IndexMundi: https://www.indexmundi.com/vietnam/age_structure.html

[4] Rate Card // AdOperator: https://go.adoperator.com/rate-card

[5] Vietnam Mobile Payments Market Analysis // Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/vietnam-mobile-payments-market